When you’re dealing with an unexpected financial difficulty and don't have savings to bail you out, you could be facing only two options: using a credit card or getting a personal loan.

Making the right decision in these situations could make or break you financially. Whether you have excellent credit or nothing more than an entry-level checking account, we’ll help you examine the details of credit card and personal loan options so that you can make a well-informed decision.

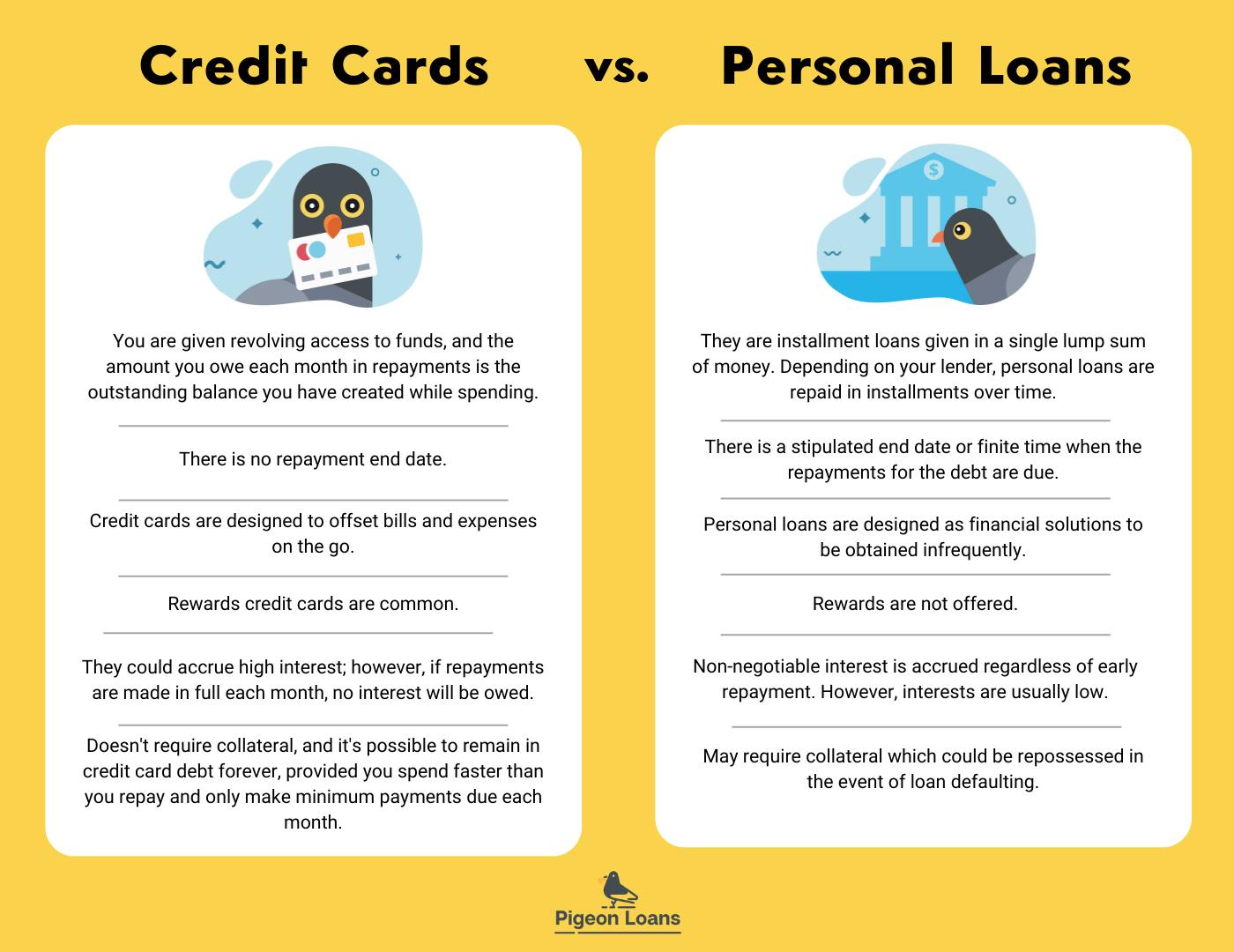

Key Differences Between Credit Cards And Personal Loans

Credit cards, borrowing money from strangers, asking for help from a friend, or applying for a personal loan can help get you the funds you need. However, each option comes with specific terms and repayment policies, and knowing all the things to consider will help you decide which works best for you.

Let’s break this down the personal loan vs credit card battle side-by-side 👷

When thinking about getting a personal loan or opening up a new credit card, you should consider the fact that your options are limited based on your credit score. The higher your score, the greater your credit card limit or personal loan you are likely to receive.

⚠️Word of Caution: Individuals with low credit scores may not always be eligible to obtain either a credit card or a personal loan. If credit score thresholds are a concern for you, use a service like Credit Karma to look up your credit score.

Summary: Credit cards are revolving loans given out at variable interest rates, and are designed to pay for small to medium debts or expenses which usually don’t require collateral. Personal loans tend to be larger loans with fixed rates and are designed to take care of medium to large debts or expenses, but getting one sometimes requires collateral.

When To Get A Personal Loan

Personal loans are financial instruments that are the better option in certain scenarios and circumstances. You may prefer a personal loan when you:

1. Want to : Most personal loans usually carry the lowest rates. They are the better option when combining multiple sources of high-interest debt into a single loan.

2. Want to finance a huge expense: Personal loans are very effective when trying to finance a large expense. For instance, if you want to buy a car, land property, or start a home improvement project, a personal loan could guarantee a smooth process.

3. Want to make monthly payments: Personal loans have great repayment plans that span a few months to some years. A personal loan would suffice if you can plan for seamless and timely monthly repayments.

4. Do have collateral: Not all personal loans require collateral, however, especially if you have good credit. Some lenders may want a cosigner or evidence of a good debt-to-income ratio if you can’t prove creditworthiness, but most don't. If you don't have collateral, you may still be able to get a personal loan with no issues.

Pros and Cons of Personal Loans

Like every financial solution, there are pros and cons to taking out a personal loan.

Pros

- Lower interest rate.

- Funds are available in a lump sum.

- They offer steady and fixed installment repayments over a long period.

- They are predictable and allow for better financial planning.

- Available for a wide range of uses.

- They accommodate lower credit scores.

- Fixed annual percentage rate (APR).

Cons

- Rates may be higher for low-credit borrowers.

- They may include hidden fees.

- Repayment is scheduled and must not be defaulted, or else collateral will be seized if the loan is secured.

- They are designed to be taken out infrequently.

- You receive one lump sum, nothing more, nothing less.

- No rewards.

How a personal loan will affect your credit score

Obtaining a personal loan could either dent or improve your credit score. For instance, if you as a borrower make timely repayments on your personal loan, the impact on his credit history will be positive - if you miss a payment, you may see some negative changes to your scores.

According to FICO, your credit score is calculated using multiple data points and revealed in a report which satisfies five categories. Each category contributes a different percentage to the overall credit score like so:

- Payment history - 35%

- Amounts owed (a.k.a. "credit utilization") - 30%

- Length of credit history - 15%

- Credit mix - 10%

- New Credit - 10%

Depending on who is issuing your loan, a personal loan will affect your credit score via different avenues:

- Application: When applying for a personal loan, your lender might conduct a deep dive into your credit, AKA a hard credit pull. This credit check gets recorded on your credit report as a credit inquiry.

- Repayment: Your credit score will increase if repayments are made timely and on schedule each month. However, a late payment (after 30 days) or a frequency of late payments will dock several points off your credit score. It will take several years for a late payment to leave your credit report.

Summary: Personal loans are great for offsetting large one-time expenses. Individuals with low credit scores may not be offered favorable terms, and how on time you are with repayments every month will affect your credit score.

When To Use Your Credit Card

Credit cards offer a line of credit, and there are many scenarios where they are the better-suited option. You should use a credit card when you want:

1. Ongoing access to funds: Credit cards offer a revolving form of credit that guarantees repeated access to funds until your limit is reached.

2. To finance smaller expenses: Credit cards are better suited to covering small bills and financing smaller expenses. They are the better option for frequent and regular purchases and expenses like utilities, groceries, shopping, etc.

3. More flexibility: Credit cards are more flexible. They allow more wiggle room in repayment and accessibility of funds, as a revolving credit card can offer an increase in credit limits.

4. To pay off the balance in full: Paying your credit card balance in full each month prevents you from getting charged interest.

5. Qualify for a zero-interest promotion card: You should obtain a credit card if your end goal is to qualify for a 0% intro apr or similar promotion.

Pros and Cons of Credit Cards

Just like personal loans, credit cards have their pros and cons.

Pros

- Access to funds whenever you need them.

- Convenience.

- Interest-free purchases from full monthly repayments.

- Access to rewards, cash advances, and cashback for cardholders.

- 0% APR promotional periods.

- Credit limit increase for cardholders in good standing.

- Ability to cover unexpected expenses.

Cons

- Higher interest rates than personal loans if full repayments aren't made each month.

- The convenience could push cardholders into racking up debt.

- Some credit cards aren't accepted for payment by all establishments.

- May have annual fees.

How a credit card will affect your credit score

A credit card can affect your credit score in many ways. Here's how:

- Application: When applying for a credit card, a hard inquiry made by the credit card company (lender) into your credit will knock a few points from your credit score. If the credit card is new, this point deduction is pretty much guaranteed. However, this hard inquiry will only affect your credit score for a few months, but it will remain on your report for up to two years.

- Credit mix: As discussed in the personal loans section, credit mix accounts for 10% of your credit score. Hence, getting a credit card when you have other forms of credit like a personal or auto loan increases the types of credit you maintain. This shows lenders that you can manage different credit accounts (provided timely payments are made), thus positively impacting your credit score.

- Credit history: The longer you've had or used credit cards, the greater the length of credit history, which accounts for 15% of your credit score. A new card can reduce the average age of your credit. Closing a credit card account may have a bigger negative effect on your credit score than opening a new one.

- Credit use: A new credit card adds to your total credit limit, which reduces your credit use rate. A credit utilization below 30% of the limit will usually help your credit score.

- Payment history: To boost your credit score, you should maintain a flawless payment history. Payment history affects your credit score by 35%. So, making all credit card payments on time, or at least the minimum amount by its monthly due date, will positively impact your credit score. In this same vein, late payments made over 30 days past the due date will negatively affect your credit score. An auto-pay system on your credit card account can help you make timely payments.

Summary: Credit cards are better suited for offsetting small debts, bills, and expenses. With credit cards, rewards are great, but missed payments will incur higher interest rates. A credit card can positively or negatively impact your credit score from the application to the repayment.

Frequently Asked Questions

1. Is it better to get a credit card or a personal loan?

- It's better to get a credit card for small regular expenses and a personal loan for larger infrequent expenses.

2. Will taking out personal loans affect my credit score?

- Yes, personal loans will affect your credit score. However, if you can adhere to the repayment plan of your lender, you'll have nothing to worry about.

3. Is a credit card loan a term loan?

- Yes, a credit card loan is considered a short-term loan with no interest if payments are made on time.

Conclusion

A personal loan with a proper is the better solution when seeking financial aid for infrequent, huge purchases or expenses. A credit card gives users consistent access to funds within a credit limit, so it is the better option for daily expenses or bills.

Both options have their advantages and disadvantages, and if all else fails, you can always call upon your friends and family for help!

Want to read more related content? Check out some more of our awesome educational pieces below: